The leader in

Password

Management

for MSPs

Improve your MSP business and protect your customers’ most sensitive data.

0

%

of security breaches come from weak or stolen passwords.

3out

of 4

companies do not have a password manager.

0

%

of security breach victims are small businesses.

Industry Leading Protection For

Managed Service Providers

The largest security threat that a managed service provider’s (MSP) customers face is from lacking or missing password security. Further help your customers close this gap by providing the security they need from their trusted advisor.

The Password Boss password management solution brings industry leading password protection to MSPs for the first time. Password Boss gives you a complete end-to-end solution for your customer’s passwords and helps them to increase security while reducing their risks from security breaches. A perfect fit in your MSP service profile.

Password Boss Integrations

Password Boss

Solution Features

A complete end-to-end, multi-tenant password management solution designed and developed by an MSP specifically for the needs and the ways that today’s MSPs work and support their customers.

Two Factor Authentication

Increase the security of customer data by enabling 2-factor authentication for all members.

Role-Based Access

Assign different roles to your team members to setup, manage and access your customers’ passwords.

Remote Control Integration

Instant login and access into your remote control application (ConnectWise Control, TeamViewer, Datto, Splashtop, LogMeIn Pro).

Secure Password Sharing

Easily share internal and customers’ passwords and digital notes with your team is done by encrypting the data using 2048 bit RSA key pairs.

Multi-Layered Security

All data stored is encrypted using AES-256 and PBKDF2, with a unique key that is created from each customer’s master password.

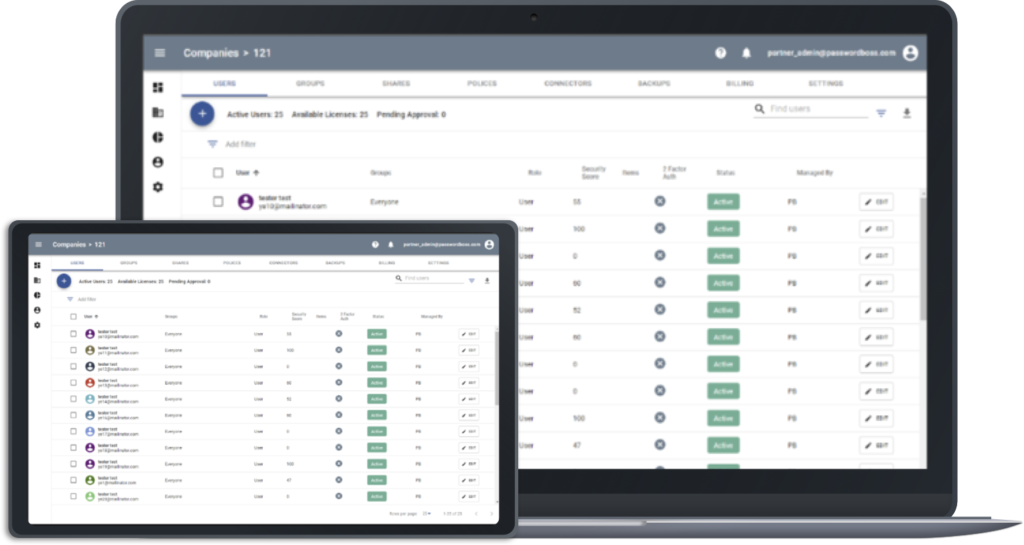

MSP Management Portal

Centralized dashboards and reports on customers and individual security scores, usage and audit logs.

Multi-Device Access

Quickly access yours and customers’ passwords and digital notes from anywhere, anytime with mobile sync.

Built-In Dark Web Feature

Scan and monitor customers’ passwords and email addresses for possible security breaches.

Auto-Logins

Fast and easy automatic login to every website.

Easy and Effecient

MSP Management Portal

Easy and efficiently access every client, user and device from a centralized multi-tenant portal. Your team can move fast and add new clients in minutes, keeping installation and support cost to a minimum.

- Customer Health Reports are a great addition to your quarterly customer reviews

- Dark Web scans show who is using hacked passwords

Upcoming

Password Boss Webinars

Register to attend one of our live Password Boss webinars and see it in action!

During our 30-minute webinar you will learn how your MSP business will benefit from the Password Boss password management solution by improving efficiencies, increasing productivity and generating new revenue streams while better servicing your customers.

You’ll get a demo tour of Password Boss with real world MSP business examples and get your questions answered.

Why Partner with Password Boss

Our award-winning password manager protects your customers’ sensitive data while growing your profits with high margins.

Highest Margins

With margins up to 50% you’ll grow your security practice and widen your current offerings.

Easy to Deploy

Automated deployments with your favorite RMM lets you deploy quickly.

Centralized Management

Our partner portal is built for easy management and configuration of every client and every device.

Increase Revenue,

Not Costs

Password Boss can actually reduce your support calls for lost passwords and password resets.

Sales and Marketing Tools

Ready to go marketing tools get you started fast.

Support and Training

Pre-sales support through deployment, our team is with you every step of the way.

Reseller and VARS

Industry leading password security, fast to deploy and easy to use, means satisfied customers and higher profits.

Highest

Margins

Aggressive margins help you grow your security practice and win more business.

Channel

Focused

We don’t compete with our partners. We work with you to build your business.

Recurring

Revenue

Password management is a long-term solution for your customers that drives strong recurring revenue.